"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

07/22/2020 at 18:54 • Filed to: None

0

0

4

4

"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

07/22/2020 at 18:54 • Filed to: None |  0 0

|  4 4 |

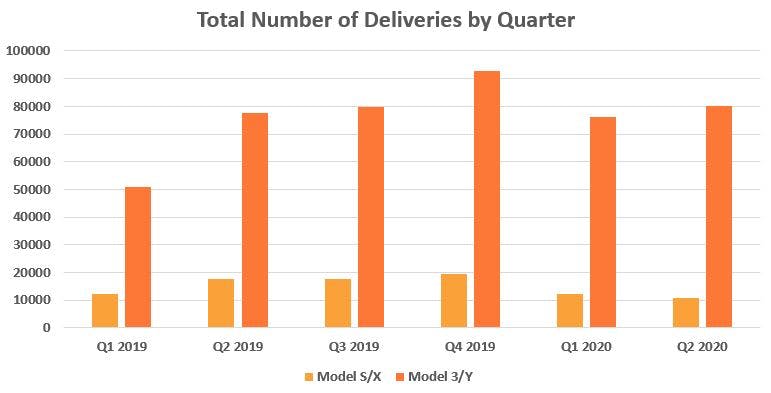

Hey, Tesla announced “surprise earnings” by “showing profit” of $100M profit** , comprised of recognition of revenues from Fake Energy Credits of well over $400 Million, plus more revenue recognition from the “release” of Full Self-Driving Software Which Cultists, er, Customers were nutty enough to pay up to $7000 for. I’m still waiting for 2016's Coast to Coast Self-Drive, BTW.

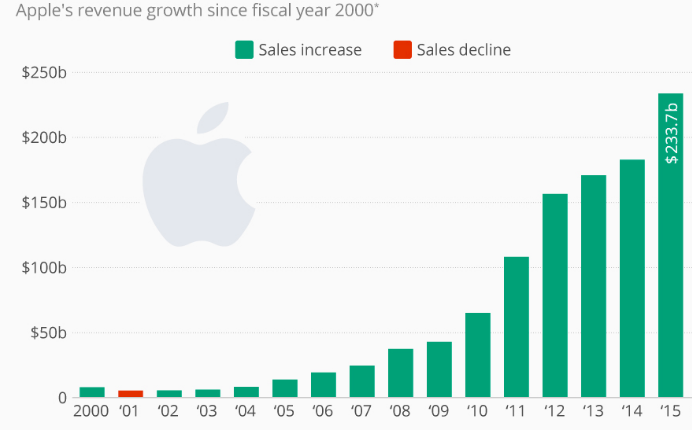

So, for anyone following this “Hyper, Mega, Super Growth Story” here’s a comparison of what Apple’s growth curve (the proxy for TSLA stock supposedly) looked like in the period after the iPhone family launched in 2007... versus what Tesla has done since launching TM3.... they look pretty much identical,. right? Amirite?

** For those of you “good with the maths” you might notice that, once again, Tesla lost approximately $350 MILLION in their sideline business of building and selling the World’s Finest Electron Propelled Vehicles in the Class of Such Cars Built from Over 8000 Laptop Batteries , which is purely tertiary to their primary business of vending Fake Energy Credits.

*** For those of you really good at the maths, you might notice that, in selling 90,000 cars for the quarter, while losing $350,000,000 doing it-- every car rolled off the line with about $3900 piled on the hood....

Virtually identical...

MM54

> SBA Thanks You For All The Fish

MM54

> SBA Thanks You For All The Fish

07/22/2020 at 19:09 |

|

You’re comparing annual revenue figures of an established company after launching a new product to quarterly sales figures from a relatively new company. It’s hard to get much more apples-and-oranges, no pun intended (which is unusual for me).

I don’t have a “side” in the whole “everyone hates or loves Tesla” thing but at least use valid data to try and make your points either way

SBA Thanks You For All The Fish

> MM54

SBA Thanks You For All The Fish

> MM54

07/22/2020 at 19:19 |

|

Well, yeah, but it’s the old problem of big numbers, right?

It’s actually far easier for a small company to post high growth rates, since you’re building off a smaller base revenue.

The sad thing (which puts the entirety of the market at risk, as this turd makes its way into mutual funds and retirement accounts, which will leave a smoking crater in the market once the bubble bursts ) is t hat Tesla’s growth rate, at least since the initial “spurt” of TM3 sales, is pretty anemic.

Even being 10X the size? Apple’s growth rate in absolute and percentage terms absolutely smokes whatever it is Tesla’s doing... But whatever Game Tesla is playing here, it’s certainly not “building cars for growth and profit”.

I get that people are excited for some reason. But I don’t see it in the numbers— and if you’re honest, you don’t see it either.

Nick Has an Exocet

> SBA Thanks You For All The Fish

Nick Has an Exocet

> SBA Thanks You For All The Fish

07/22/2020 at 20:05 |

|

I’m increasingly annoyed by “surprise earnings”. Like... you didn’t know that you would have energy credits?

SBA Thanks You For All The Fish

> Nick Has an Exocet

SBA Thanks You For All The Fish

> Nick Has an Exocet

07/22/2020 at 23:08 |

|

Some poor MBA in “the Finance Group” must have the task of modeling scenarios... “OK, even if we only ship 135 cars this quarter for revenue, we can STILL show a ‘surprise profit’ because we have $2.5 Billion of these 100% Gross Margin Fake Energy Credits banked”.

So, yeah, to your point it seems pretty disingenuous, although I’m getting disenchanted with the investment banking equity analysts who seem happy to gloss over that this is still a “car company that’s never made any money building actual cars”.